Introduction

Investing in property is a great ingredient for any diversified investment portfolio however unfortunately for many it is difficult to get involved due to the high barriers to entry.

Most people will struggle to buy properties outright, particularly those in the South of England, and many will struggle to put together a deposit to get a buy-to-let mortgage and buy an investment property.

And even if you have the sufficient means, taking the time to (a) source good deals; (b) find reliable agents and contractors; and (c) source good tenants is a headache you may not be willing to take on. Bear in mind that the best rental properties may be far north, and access may not be the easiest.

In recent years a number of mainstream platforms have emerged that offer investors with smaller sums of capital opportunities to invest together so that they can get a small chunk of a property that they could not afford to buy outright.

Unfortunately, all of these are problematic from a sharia perspective owing to the debt they introduce into their offering.

Luckily though, there are now an exciting array of sharia-compliant property products either already-launched or coming to market soon.

The oldest and most established player in this space is Yielders*.

In this article we share:

- how the Yielders model works;

- how our experience was using their platform;

- the pros and cons of using Yielders;

- What is “Top Yielders”;

- Alternatives; and

- our verdict.

Yielders Model

Yielders is a marriage between a tech platform (proprietary) and a deal-sourcing team in the back end. Certain of their founders have a background and family connections in the property industry (including an estate agency that manages over 2000 properties across London.). This helps them source off-market deals quickly before competition becomes aware of the opportunity. The impression I get is that their connections in the residential space are much stronger than their connections in the commercial space (which is fine, as the main focus of their projects have been residential to date).

Yielders sift through a range of opportunities looking for a commercially-viable project to take on. Shortlisted projects then have further due diligence carried out before their investment committee will finally decide whether to go ahead or not. The process has to be rigorous and methodical as Yielders is an FCA-authorised company and must meet their standards for the offering and marketing of such products.

Once the investment committee has signed off, Yielders will go ahead and create the special purpose vehicle (an “SPV” – aka a limited company create solely for the purposes of holding this particular investment) through which the property will be bought. Yielders has a panel of pre-funders who it looks to, to purchase the entire asset and then sell down to the crowd once the project publicly lists. Pre-funders are high-net-worth people with large amounts of cash that would otherwise not be making a return and the benefit for them is that putting money into Yielders and making a rental return for the duration they hold the asset (pro rata to their holding) is a bit like putting their money into a decent savings account.

Prefunding has a bunch of benefits such as, (a) the crowd actually get a chance to participate at all; and (b) there is no uncertainty whether or not the deal will actually happen – the property has already been bought by the Yielders SPV and the deal is going on regardless. If the crowd doesn’t completely buy out the prefunder, the prefunder simply continues holding onto the investment.

The crowd is the offered the opportunity to buy shares in the SPV (which is essentially equivalent to your share in the underlying property) and the prefunder sells down his stake.

Once the property has been funded, Yielders will engage with (a) their long-term contacts at Tier 1 tenants (usually blue-chip companies) with whom all the management terms are agreed up-front, and (b) if needed, appropriate local estate agents to manage the property day-to-day, and they will liaise with the Tier 1 tenant/estate agent to ensure relevant monies are paid into your Yielders wallet monthly.

If you would like to sell before the scheduled sale of the property, you can contact Yielders who will offer your stake on their platform. There is no guarantee that someone will buy your portion, but historically each such offer has been taken up.

Once the scheduled sale date comes around, the property will be sold by Yielders and all initial monies plus pro rata appreciation (minus Yielders and other sales fees) will be returned to your Yielders wallet.

You can withdraw from your Yielders wallet at your own convenience.

Yielders Platform

The Yielders platform is well-designed and we didn’t have any major complaints.

On-boarding is relatively quick. I plug in all the basic information that a platform like this needs, plus a proof of ID and proof of address, and then I wait until they sign off on my details. I get a confirmation the next day and am ready to deposit and invest. (Through subsequent conversations with Yielders, I understand you are able to invest £1500 straightaway without a confirmed-and-approved profile).

You can deposit using card or bank transfer – though card deposits are restricted to £1500. I ran into some troubles depositing by card for some reason so eventually transferred via my bank.

A quibble I had was that investing in a property can at times be a little bit unintuitive as some properties are fully funded but the system hasn’t caught up yet, and others are listed as fully-funded but unless you screen them out, the system will show you those ones too. You can’t also screen out the “top Yielders” properties, which you might want to, unless you can stump up £50,000 per investment.

A nice touch is that you have to download the basic documents that lay out the specific investment deal before you can actually click invest. This then allows you to enter the amount you’d like to invest, and you’re away – provided you have enough money in your wallet to be able to make that investment amount.

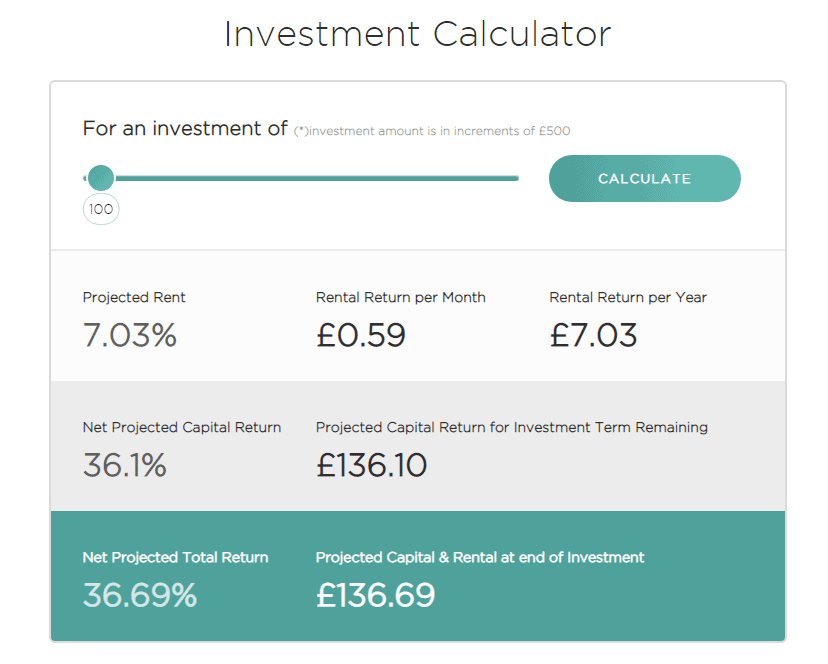

Another nice touch is the calculator that allows you to punch in the numbers you may want to invest and then shows you the kinds of returns you’d be looking at for that over the course of the term.

But things don’t end there. Every month you get an update email from Yielders setting out how much rent you have received, how much is in your wallet, and how much your portfolio is worth. I really like this feature as it helps me keep track of this particular investment stream.

But things don’t end there. Every month you get an update email from Yielders setting out how much rent you have received, how much is in your wallet, and how much your portfolio is worth. I really like this feature as it helps me keep track of this particular investment stream.

Pros

- The Yielders team are all professionals with experience in this field and are approaching things the right way

- You can invest in property from as little as £100

- No mortgage or estate agent or day-to-day involvement in a property

- Better returns than savings accounts

- This is a bricks-and-mortars property-backed investment

- There is liquidity optionality

- FCA authorised

- Genuinely looking to innovate on the tech front as they own the tech

Cons

- Returns are relatively unexciting at retail investor level, though they are much better at the “Top Yielder” level. But to get those you need to be investing £50k+ into the platform.

- The deal flow is currently not great. I want there to be enough properties live on the platform at all times so as to give investors a genuine choice. But I expect deal flow to increase sharply as they have recently fundraised over 500k to grow the business.

- The liquidity optionality is yet to be thoroughly tested as only a few people have tried to sell thus far. Inevitably, a Yielders investment will be less liquid than, say, a share in a company on the stock market.

- There is no guarantee you will successfully sell and exit the investment at the end of the term. It will depend on finding a buyer and getting a fair price. I’d expect this to usually happen, but there may be some slippage on timing on some deals.

What is “Top Yielders”?

Better returns, but higher risk. Usually shorter terms too.

If you want to invest in this but only have £25k and want to build up to £50k, we understand that Yielders may consider this on a case by case basis.

If interest in Top Yielders, we can put you in touch and put in a good word. Just drop us a line via our contact page.

Alternatives

The closest equivalent to Yielders is Igloo Crowd. Igloo is much younger, not as well-funded, doesn’t have a pre-funding model, and is not directly FCA-authorised (though they are indirectly authorised). They focus on buy-to-sells rather than buy-to-lets, though they have some of those too. Their deal-flow is even patchier than Yielders, though the returns that they offer are stronger. I have previously invested with them but, as they don’t have a pre-funding model, I’m still waiting to see if my investment actually goes anywhere.

Wahed Invest* is not a direct equivalent to Yielders, but it is similar in the sense that it is a regulated sharia-compliant investment platform available in the UK. The kind of returns Wahed offers are slightly above what Yielders offers on its buy-to-let deals, but marginally so. One would expect that in a declining stock market (we’ve been in a rising stock market for the last eight or nine years) Wahed and Yielders would roughly even out in terms of return. The benefit with Wahed is that it is a lot more liquid and you can withdraw your cash at any time and can be more confident of getting it back, but the downside is that the stock market is unpredictable and you can never get as consistent a return as Yielders will be able to offer via rental payments. To my mind, Wahed and Yielders are different types of investments into fundamentally different asset classes. I invest a little in both, and think that’s a decent way of diversifying one’s portfolio.

Finally, there’s the DIY approach to property investing. It is actually possible to buy relatively cheap properties still, particularly in the north. You can pick up some downtrodden properties for as little as £20,000 at auction sometimes. Of course, renovating and then either buying or renting such properties will give you a significantly higher return than going via Yielders or any other intermediary. You could get somewhere between 10-14% on the rent, and, if you use a buy-to-let mortgage, you could increase that to 15-20% return. Those numbers sound great, but ultimately doing the work, dealing with the late night tenant call to fix a toilet in a house that is hundreds of miles from yours, and handling all the tax and accounting paperwork generally deters most people from this route.

Verdict

Yielders is great if you don’t have enough money or time to do your own thing. It is not as liquid as other investment types (but they are working on this) so really this is an investment class for people who are looking to invest for 3-5 years.

One thing I’d like to see from Yielders as they grow is better returns for the retail offering. Perhaps the way to achieve this is by (a) adding a little bit of commercial property into the mix; and/or (b) adding in sharia-compliant financing to help leverage the returns.

Overall, a very solid property investment platform that is much-needed by the British Muslim community.

*As a comparison website, IFG pays its bills through referral fees. So if you use this link it supports us in providing this service for the Muslim community. Our views and coverage remain strictly independent.