Stock Market Rally: What does it mean for your portfolio?

21 July 2023 6 min read

5 min read

Published:

Updated:

Ibrahim Khan

Co-founder

Sarwa is a new roboadvisory platform based in the the UAE. They are a mainstream platform but as part of their offering they also offer a halal portfolio.

In this article we dig into:

Sarwa’s halal portfolio consists exclusively of Blackrock’s ishares ETFs:

Here’s some data from Bloomberg on these ETFs:

| Name | Dividend Yield | Management Fees | 1-Year Return | 3-Year Return | 5-Year Return |

| iShares MSCI USA Islamic UCITS ETF | 1.59% | 0.5% | -7.72% | 2.81% | 2.98% |

| iShares MSCI World Islamic UCITS ETF | 2.14% | 0.6% | -10% | 1.6% | 1.77% |

| iShares MSCI EM Islamic UCITS ETF | 1.87% | 0.85% | -13.38% | 0.78% | -0.23% |

The data has been taken on 15 April 2020, so needs to be taken in context of the coronavirus crisis which has made global stock markets drop by about 30%.

Sarwa have since provided more up-to-date figures that put their 3-year annualised return between 5.41% and 8.88% for their respective portfolios. You can compare between them on our investment comparison engine here.

In light of that, the iShares world actually holds up relatively well. Being ETFs (Exchange Traded Funds), they hold hundreds of stocks in each portfolio and are well diversified. This means that in hard times the losses are a little cushioned and in good times the returns are a little subdued.

This would be in contrast to investing in a high conviction managed fund or even investing directly in stocks yourself. If you did that, when times are going well, your portfolio (which is likely to be concentrated into only 5-20 stocks) could vastly outperform a typical ETF. However in hard times, the same portfolio could vastly underperform a typical ETF.

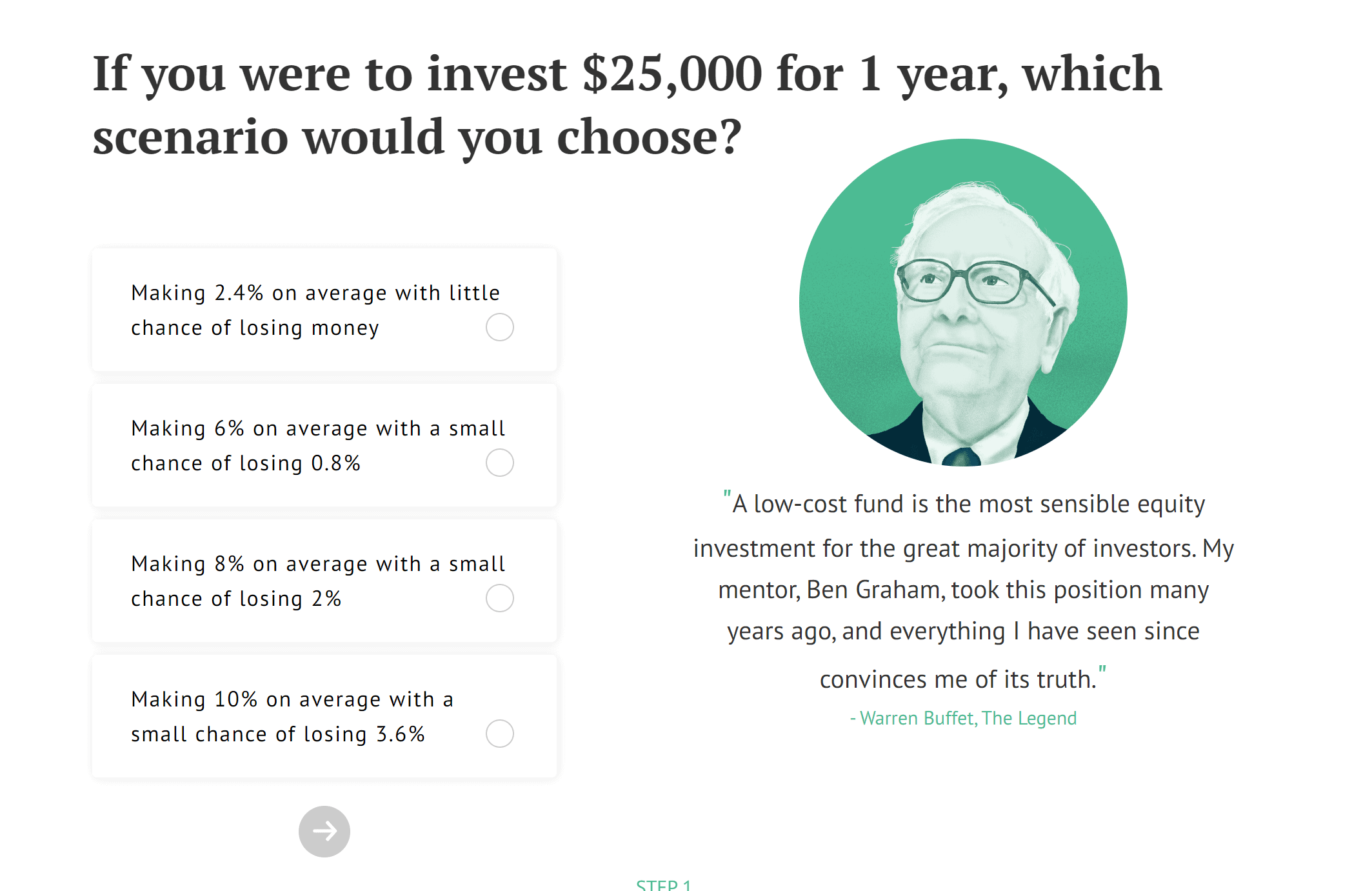

Sarwa sign you up nice-and-easily, with little info needed. They then add value to you by taking you through their portfolio selector quiz.

I liked the quiz. It asked good questions and had nice quotes on the right to give a bit of education and flavour to the right. Here are some examples:

At the end of it, you are given a recommended portfolio. My portfolio was a 4/7 risk even though I think I chose the most aggressive options.

That suggests to me that a big part of how the portfolio was created was looking at my age, salary, net worth, and whether I have dependents or not.

It would be nice to somehow override the system in these kind of situations if you are an investor like me who is either ultra-conservative or ultra-aggressive.

That small quibble aside, a decent experience.

The recommended portfolio screen also shows you details of your chosen portfolio, its historic past performance. It would have been nice to see other portfolios and their historic returns too though.

But I guess, if you can’t choose them, and Sarwa wants to point you against choosing anything that is against its own recommendations, then it makes sense for them not to show you other portfolios’ historic returns.

Sarwa then invite you to sign up for your account. This process is again very painless. They ask for a selfie, a passport scan, and a proof of address. The tech is operated by Onfido – leaders in this field. At the moment of writing, I have just submitted my documents and await a response.

The question is, can you get access to the iShares ETFs elsewhere for cheaper?

If you invested £5000 into AJ Bell’s ISA account and bought the three iShares funds, you would pay £17 to AJ Bell.

In contrast with a roboadvisor like Sarwa you pay 0.85%, or £42.50.

The benefit you get with Sarwa for that extra £20 or so is that you can talk to someone, someone is looking at your portfolio and adjusting it as markets change, and there are no exit fees. To me that’s worth it for £20.

You can read our detailed review of Wahed here.

In short though, Wahed invests in similar underlying ETFs, so it is expect to make a similar return.

They do however offer access to a sukuk fund – which is definitely a string in their bow over Sarwa.

However Sarwa’s fees are about 16.5% cheaper as Wahed charged 0.99%, or £42.50 for a £5000 investment.

You can also call Wahed however their phone service is much more about customer support than providing an experience of talking to a finance advisor. They do offer regular webinars and in-person meetings though where it is possible to discuss finances with Wahed people.

Another thing to note is that Wahed is much more global in tone and approach. It is the older and bigger of the two platforms too. Sarwa on the other hand is very focused on the Middle East at this stage and its customers there. In time though, I suspect Sarwa will branch out globally too.

You can compare many halal investment options on our comparison page here.

A very respectable and solid offering overall. I like Sarwa and think they’re going places. In time I expect them to add in a sukuk into their portfolio mix which will really help.

For now though, you could invest the “equity” portion of your portfolio with them and just get yourself a more aggressive portfolio so that as little as possible of your portfolio is sat in cash.

You can invest with Sarwa here.

21 July 2023 6 min read

15 February 2023 7 min read

10 January 2023 11 min read